TL;DR

- The Lekker Protocol, a winner at ETH Lisbon 2022, is here to create tokenized products in DeFi. Its genesis product sets a new way of creating leverage in DeFi, backed by the liquidity of top-tier lending protocols.

- Leveraged positions are tokenized and resistant to liquidation penalties. Lekker calls it Lending Backed Derivatives (LBDs). Could Lekker be a new category-defining protocol?

- Lekker is made for everyday DeFi users, whales, DAO treasuries and even trading platforms. It is simple, efficient and powerful.

What is Lekker about? A brief intro.

When Lekker was created, its goal was simple. To make it (really) easy to build a leveraged position in DeFi, straight from a self-custodian wallet. That was Lekker's first building block to get on a journey to build the future of Decentralized Finance (DeFi), one money lego at a time.

Why is this important? Leverage enables higher capital efficiency, hedge and risk management opportunities.

Lengthy manual ‘multi-hops’ only to get some leverage…

Until now, the most common approach to building leverage in DeFi required users to engage on a manual ‘multi-hop’ journey. This involved:

- Step 1: supplying collateral on a lending protocol (platform A),

- Step 2: borrowing against that collateral,

- Step 3: swapping the borrowed asset on a Decentralized Exchange (DEX) (platform B),

- Step 4: rinse and repeat steps 1 to 3 many times until attaining the desired leverage.

This is a suboptimal user experience. Going from platform to platform and executing manual transactions. So much time, gas fees and spreadsheets only to get some juicy DeFi leverage.

…or bridges to DeFi trading platforms.

The alternative to manual ‘multi-hops’ is to use a DeFi trading platform, but then again, not without bridges and risks. There are many DeFi trading platforms, each with its own value proposition, and their approach often involves:

- bridging assets,

- reproducing a trader experience similar to Centralized Exchanges (CEX), and

- creating and owning liquidity.

Lekker takes a totally different approach. Read on.

Your keys, your assets, your leverage. DeFi needs to be the standard.

Lekker utilizes the existing liquidity of notable DeFi lending protocols to create a unique and innovative solution for building leverage without bridging and siloing assets in a specific platform.

Leveraged positions are tokenized and resistant to liquidation penalties (the protocol prevents penalties only, not liquidation). These features, combined with the idea of ‘‘leverage made simple”, received praise and made Lekker Finance a winning project at ETH Lisbon in late October 2022. Off to a good start!

ETH Lisbon 2022, Academia de Ciencias de Lisboa

One week later, the significant event of FTX crashing and filing for bankruptcy further strengthened the need for transparent, trustless, and permissionless applications that only DeFi can offer.

How does it work?

A more robust approach to building leverage

On Lekker, users make three choices – which asset to leverage, how much to leverage, and which asset to use as collateral/payment – and then execute a single-touch transaction. Without giving too much of the "secret sauce", Lekker takes the chosen asset and conducts a series of supply-borrow-swaps against the leveraged asset.

As a result, the user receives a token (ERC20, for the tech-savvy out there) that can integrate a portfolio and be traded or redeemed for profits (assuming it was a good trade).

We call this new type of derivative Lending Backed Derivatives (LBDs).

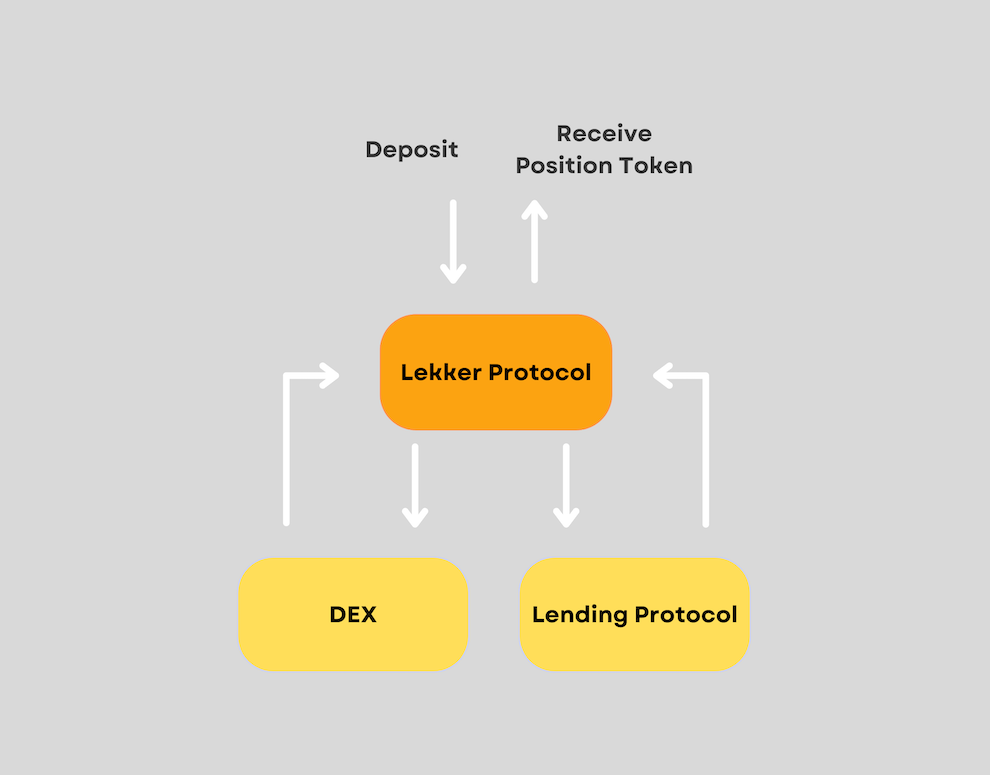

The parties involved are:

User

Deposits collateral to create leverage.

Lekker Protocol

Gets the most efficient way to gather liquidity and swaps to open the leverage.

DEX

Provides liquidity for token swap capability.

Lending Protocol

Brings lenders together to provide liquidity for loans.

Lekker's liquidity comes from non-custodial, distributed, 100% DeFi sources that are verifiable on the blockchain. Transactions are carried out using trust-free and permissionless DEXs and Lending Protocols.

Lekker is for everyone

For everyday people, everyday whale

With an easy-to-use interface, people can deposit their assets, choose how much to leverage and execute the transaction with a single touch. The ease of opening and closing positions sets Lekker apart, making it an essential tool in the DeFi universe. It is suitable for those just getting started in leverage trading as well as experienced traders.

For expert traders seeking more sophisticated tools, Lekker plans to build more tools. The development of those tools will be prioritized together with the community.

For DAOs and treasury managers

The use of Decentralized Autonomous Organizations (DAOs) has been growing in the past years which increases the number of treasuries to be managed. DAOs currently hold several billion in their treasuries and most treasury managers have limited options to manage their treasuries in DeFi apart from lending and borrowing.

Here comes Lekker, for DAOs to have another lekker day.

Treasury managers can hedge risk by holding the leveraged token in their treasury. The robustness of the Lekker Protocol provides an amazing opportunity for treasuries to preserve capital in any market condition.

It is still “early days” for the Lekker Protocol, but Lekker is a key building block to an entire ecosystem that is yet to flourish in the years to come.

For trading platforms and strategy builders

Strategy-building protocols and DeFi leverage trading platforms are on the rise. We can only think of what is yet to come because, again, DeFi is the future (or should we say present).

With the Lekker leverage being tokenized, there are many possibilities to integrate it into portfolios and automated trading strategies. At the same time, Lekker functions as a gateway for developers and other trading platforms to access DeFi liquidity.

So what’s next, Lekker?

The Lekker Protocol is being refined and tested, tested, tested. Security is our key priority. We plan to open up for community testing, and want to make sure that the community has a lekker time even when testing.

We hope you are as excited about Lekker as we are! Follow us on Twitter and https://lekker.finance to stay tuned and see what else Lekker will bring to the world of DeFi tokenized products.